Nasty selloff after Jay Powell addressed the conference in Jackson Hole

Jackson, WY USA - December 24, 2020: Rafting bears are among the many whimsical outdoor displays decorating local shops in the year-round resort town of Jackson in Wyoming.

His comments were hawkish indicating the Federal Reserve will continue to tighten economic conditions by raising rates further.

Not exactly surprising. Still, the impact on the market was sharp and immediate.

Do you think people were waiting to see what he had to say?

@RampCapitalLLC

I wonder when he started talking

A precarious predicament

So where does that leave us? Much more bearish looking than this time a week ago.

From last week’s review -

The S&P 500 has been very strong but this week couldn’t get over the 200-day MA. It’s now resting on the volume-weighted price anchored to the all-time highs (ATH AVWAP). The bull case is to hold and bounce from $420 as that's been such a heavily watched level. Below that watch for a move to test the 21-day EMA, and if that doesn't hold $410 may help.

So here we are, looking up at SPY 410, QQQ 310, and IWM 190.

Not bullish.

Can prices find support and resume the move higher?

Or do they break lower signaling “risk off” once again?

You don’t need to be a technical analyst or a chartist to see things are pointing lower.

Even if support does hold, today’s action results in a very ominous-looking red candle. Getting above the high of today negating this candle will be the first order of business for the bulls. The sooner it happens (if it can happen) the better.

Down below, we’re looking at the 50-day moving averages, then the July 26 pivot, and finally the June 16/17 low as potential support.

$SPY

$QQQ

$IWM

$VIX up over 17% today ⚠

$DXY looking for a breakout

Quite a nasty day

As always; know your time frames and no your outs.

Risk management is critical in markets like this.

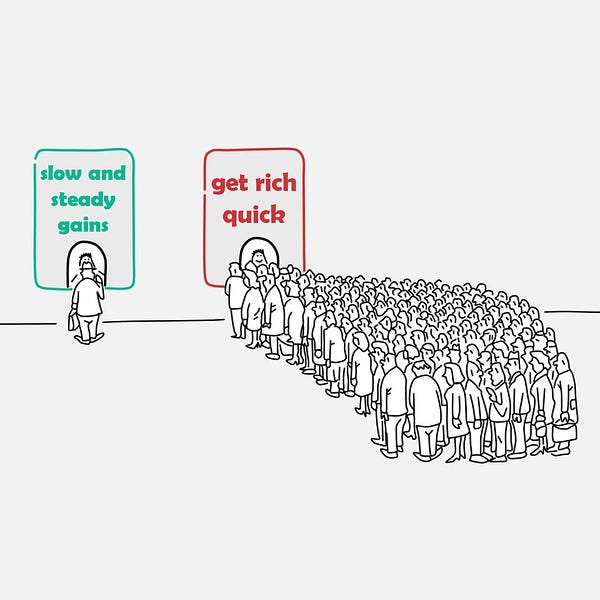

And don’t get in a hurry.

#Patience

@tradingview

Kurt Vonnegut is one of my favorite authors. And by all accounts (that I’ve read anyway) a nice and funny guy.

Slaughterhouse-Five

The Sirens of Titan

If This Isn't Nice, What Is?: Advice for the Young

Harrison Bergeron

Great place to start if you haven’t read them yet.

This story is more great advice for young people.

And while we’re talking about writing…

Thanks for reading. If you haven’t subscribed, do that now. And if you haven’t shared this with a co-worker, friend, or family member yet I would really appreciate it if you did.

As usual, I will be on Twitter tomorrow morning with a look at some weekly charts. Come chime in and let me know what you’re looking for or what charts you’d like to see.

***This is NOT financial advice. NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”) a SEC registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent the opinions of that person only and do not necessarily reflect the opinions of T3TG or any other person associated with T3TG.

It is possible that Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual or it may reflect some other consideration. Readers of this article should take this into account when evaluating the information provided or the opinions being expressed.

All investments are subject to risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants or other qualified investors prior to making any investment decision.