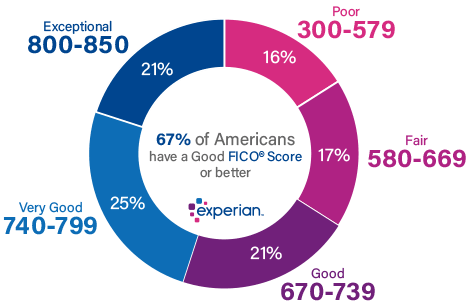

At 25 years old, I have a credit score of 801; the top percentile.

With a score this high, I'm able to take advantage of perks like for instance, increasing my monthly credit card limit to $16,000.

Here are the 5 things I did to achieve a high credit score at an early age.

#1: Automated Payments

Ever since I got my 1st credit card at 18, I've never missed a payment.

This is because I set up automated payments so that my entire bill gets withdrawn at the end of each billing period. Always pay in full, not the minimum.

#2: Multiple Accounts

When you have multiple credit accounts with different institutions, it increases your score.

I separate my accounts for different areas of my life. For example, I have my personal credit card for daily purchases, and a separate account for my student loans. In total, I have 5 different accounts.

#3: Keeping Credit Cards Open

Yes, closing credit cards will decrease your score!

If I have a credit card I don't use anymore, I simply leave it alone. The only exception to this rule is if that card has a monthly maintenance fee.

#4: Spending Less Than 30%

This may be different for Americans, but in Canada, another way to get a better score it to spend less than 30% of your card limit.

So with my limit of $16,000, I make sure I spend no more than $4800 each month.